What Does Feie Calculator Do?

Some Known Details About Feie Calculator

Table of ContentsThe Buzz on Feie CalculatorThe Feie Calculator DiariesSome Ideas on Feie Calculator You Should KnowHow Feie Calculator can Save You Time, Stress, and Money.Feie Calculator Things To Know Before You Get This

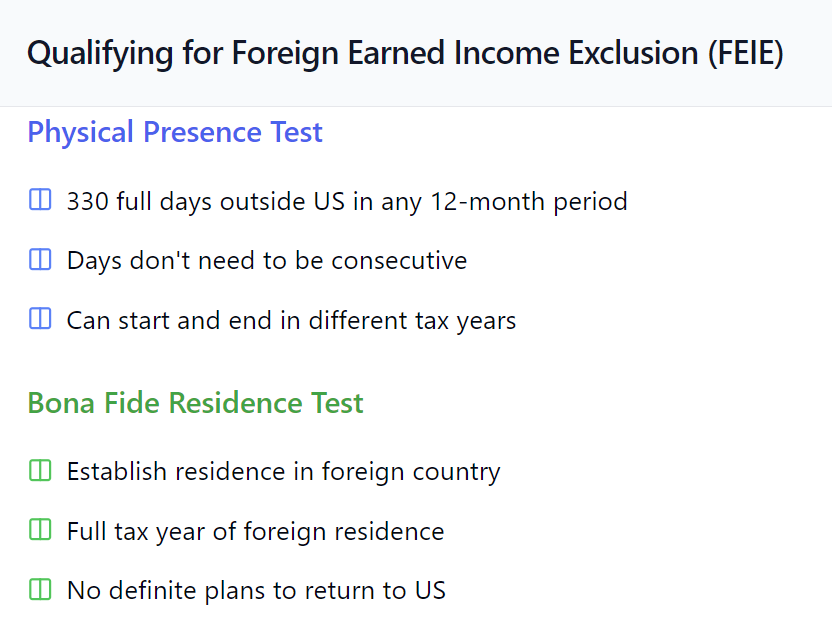

Tax obligation reduction in the United States The United States tax obligations citizens and residents on their worldwide earnings. Citizens and citizens living and functioning outside the U. https://gravatar.com/feiecalcu.S. may be qualified to an international gained income exclusion that reduces taxable earnings. For 2025, the optimal exclusion is $130,000 per taxpayer (future years indexed for inflation)Additionally, the taxpayer must satisfy either of 2 examinations:: the taxpayer was an authentic resident of a foreign country for a period that consists of a full united state tax obligation year, or: the taxpayer must be literally existing in an international nation (or countries) for at the very least 330 full days in any kind of 12-month duration that starts or finishes in the tax obligation year concerned.

Even more, the examination is not fulfilled if the taxpayer proclaims to the international federal government that they are not a tax obligation homeowner of that country. Such declaration might be on visa applications or income tax return, or enforced as a condition of a visa. Eligibility for the exclusion might be impacted by some tax treaties.

The "housing exemption" is the quantity of housing expenses in extra of 16% of the exclusion limitation, computed on a daily basis. It is likewise based on the number of certifying days, and is limited to a particular buck quantity based on the area of housing. The exclusion is limited to earnings gained by a taxpayer for efficiency of services outside the united state

Feie Calculator for Beginners

Where revenue connects to solutions both in the united state and outside the U.S., the earnings must be allocated. Special rules relate to Foreign Service and army employees. The exemption is an election. Taxpayers may assert the exemption only if they file internal revenue service Form 2555 or Form 2555-EZ. The type should be attached to a prompt submitted united state

Some Known Details About Feie Calculator

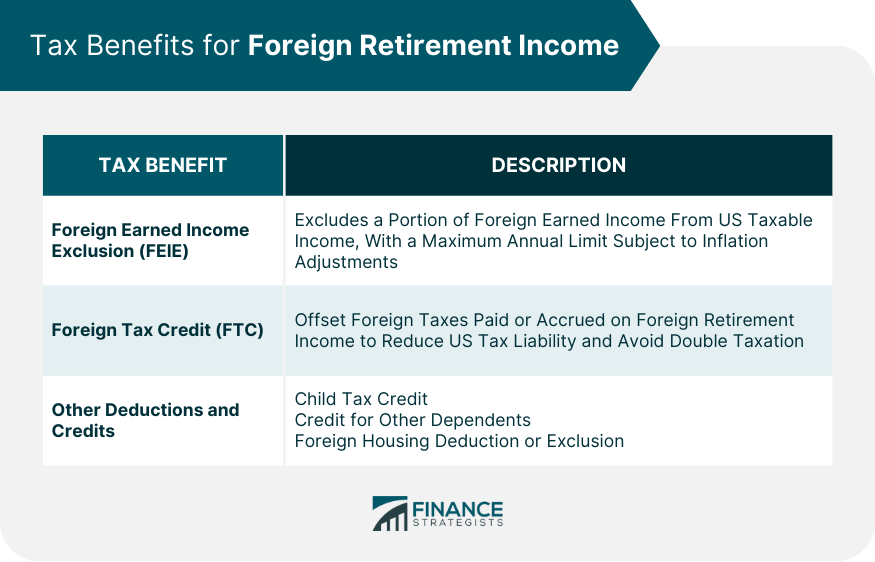

In many cases, the FEIE can also assist you pay less in taxes as a deportee than you would in the United States. Of program, equally as with all tax obligation methods, whether or not the FEIE is best for you relies on your private situations. While the nitty-gritty details of tax obligation breaks like the FEIE can be intricate, we're here to simplify it for you.

Keep reading as we damage down what the FEIE is, that gets approved for it, how to assert the exclusion, and extra. The FEIE is a major tax obligation break for expats that allows Americans to omit a certain amount of their international earned earnings from normal government income taxes. The other crucial tax obligation breaks for deportees consist of the Foreign Tax Credit Scores (FTC) and International Housing Exclusion/Deduction (FHE/FHD), both of which we'll go into more detail on later on.

holiday or severance pay) On the other hand, you can not omit unearned/passive income under the FEIE. Kinds of income that are disqualified for the FEIE consist of: Rental revenue Dividends Resources gains Interest from checking account or investments Pension/retirement revenue Social Safety benefits Annuities Kid support/alimony Distributions from a trust fund Note: While unearned revenue does not get approved for the FEIE, it may get approved for other tax obligation breaks.

Feie Calculator Fundamentals Explained

It does not, nevertheless, exclude your income from other kinds of taxes. Independent expats that declare the FEIE has to still pay a tax obligation of 15.3% (12.4% for Social Safety and security, 2.9% for Medicare) on their internet self-employment revenue. Note: Americans working abroad for US-based employers are accountable for simply 7.65% in US Social Security taxes, as their employers are called for to cover the other 7.65%.

Before you declare the FEIE, you should satisfy at the very least one of 2 different tests., you must try this site be physically existing in a foreign country (or countries) for at least 330 full days out of any365-day duration that overlaps the pertinent tax year.

Keep in mind that only days where you spent all 1 day beyond the US count as a full day for the functions of this test. Proving you satisfied the Physical Existence test requires you to log all of the countries you were physically existing in over the appropriate 365-day duration and just how much time you invested there.

The Single Strategy To Use For Feie Calculator

If so, you will certainly require to total Part VI. Otherwise, you can avoid ideal to Part VII. This area is only for those who prepare to assert the FHE or FHD. In it, you'll share information on your foreign real estate expenses, consisting of just how much you sustained, where you sustained them, and whether your company repaid you for any one of them.

While a lot of Americans have a tax due date of April 15th, deportees obtain an automated two-month extension till June 15th. Keep in mind: If any of these days drop on a weekend break, the tax due date will certainly move to the following business day afterward.